Understanding the Importance of Financial Planning in Nonprofits

Nonprofit organizations play a pivotal role in meeting community needs, but their success hinges on thoughtful financial planning. Unlike for-profit entities, nonprofits must meticulously balance mission-driven initiatives with financial sustainability—making every dollar count toward impact. Integrating careful budgeting, forecasting, and risk management helps allocate resources efficiently, advancing core objectives without jeopardizing future operations.

A comprehensive approach to finance also makes nonprofits more attractive to donors, partners, and grantmakers. By instituting sound fiscal policies, organizations can instill confidence and establish credibility. For expert insights on navigating this landscape, Aaron Werner Raymond James, Vice President at Raymond James, offers valuable perspectives for nonprofit leaders looking to enhance their financial stewardship and strategic planning capabilities.

Developing an Investment Policy Statement

A thorough Investment Policy Statement (IPS) provides clarity and direction for managing a nonprofit’s assets. An IPS formalizes financial objectives, specifies risk tolerance, and outlines investment guidelines by focusing on the organization’s mission. Creating an IPS allows board members, executives, and advisors to make cohesive, transparent decisions supporting short- and long-term goals. Additionally, it fosters a disciplined investment approach, mitigating the temptation to react emotionally to market fluctuations.

Best practices suggest reviewing the IPS annually and adjusting it as circumstances evolve. This regular scrutiny ensures that the policy remains relevant and practical, especially as the organization’s circumstances and the broader economic climate change. For more on the structure and implementation of a strong IPS, visit the National Council of Nonprofits.

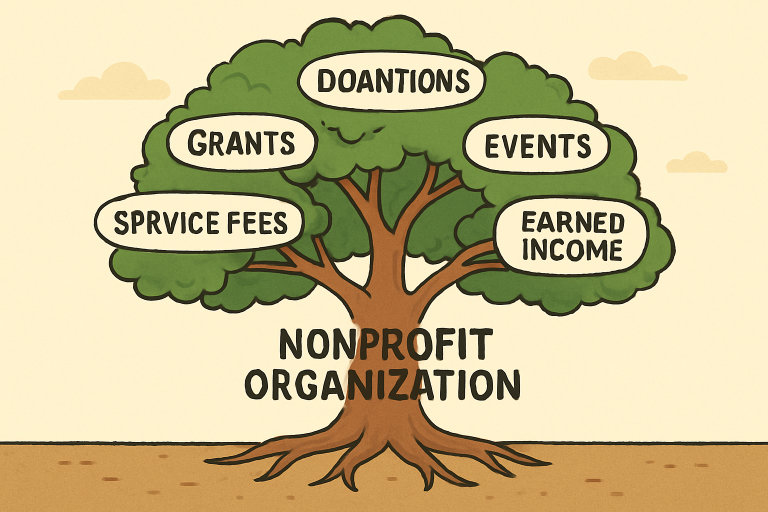

Diversifying Income Streams

Relying solely on one funding source, such as individual donations, can be risky—even for well-established nonprofits. Resilient organizations diversify their income streams by incorporating grants, fundraising events, service fees, corporate sponsorships, and earned income programs. This stabilizes annual revenue and positions the organization to weather economic downturns or unexpected funding cuts.

Each funding source has its own challenges and demands, so managing a diverse portfolio of income streams requires proactive relationship-building and effective tracking. Implementing robust fundraising strategies and cultivating long-term partnerships with grantmakers, donors, and community stakeholders will bolster financial resilience and enable mission fulfillment in varying environments.

Implementing Transparent Financial Practices

Transparency is a hallmark of trust in the nonprofit sector. Organizations that maintain open communication about allocating resources, report regularly to stakeholders, and follow standardized accounting practices create a culture of accountability. Adherence to guidelines set by authorities like the Financial Accounting Standards Board (FASB) demonstrates a commitment to best practices and legal compliance.

Publicly sharing annual reports, audited financials, and performance outcomes further encourages participation and investment from donors and partners. According to the Forbes Nonprofit Council, this practice is essential for fostering donor loyalty and sustaining organizational credibility.

Engaging Financial Advisors With Nonprofit Expertise

Nonprofits can benefit from collaborating with financial advisors who specialize in nonprofit management. These experts offer insights into tailoring investment strategies, optimizing fundraising, and maintaining compliance with evolving regulations. An advisor well-versed in nonprofit challenges can help organizations maximize their resources and prepare for growth, as they understand the nuances of balancing mission, risk, and operational needs.

Advisors can also assist in board education, policy development, and long-range financial planning—invaluable services for organizations aiming to thrive in a changing landscape. Seek out professionals whose track record includes similar organizations, and verify their commitment to transparent, impact-driven consultation.

Regular Financial Audits and Assessments

Routine financial audits and assessments are essential to healthy nonprofit management. Independent audits provide objective feedback, help uncover inefficiencies, and ensure compliance with regulations and donor requirements. Annual financial assessments give boards and executives clear insight into assets, liabilities, cash flow, and reserves—fundamentals for intelligent, strategic decision-making.

Regular audits encourage a culture of accountability and help mitigate risks. They are also often required to secure major grants or government funding, and many donors look for evidence of reliable auditing practices before making sizable commitments.

Leveraging Technology for Financial Management

Financial management systems and specialized nonprofit software are transforming how organizations approach budgeting, reporting, and compliance. Cloud-based accounting tools centralize financial data, enable automated reporting, and support collaborative oversight by staff and board members. With real-time dashboard views, nonprofit leaders can track finances efficiently, reduce manual errors, and focus more on programming.

Selecting software designed explicitly for nonprofits ensures integration with fundraising platforms, donor databases, and regulatory reporting, all of which contribute to streamlined operations. Investing in technology is no longer a luxury but a necessity for sustainable growth and effective stewardship.

Conclusion

Nonprofits face unique financial challenges, but they can sustain growth and further their missions with strategic planning, disciplined investment, diligent transparency, and expert guidance. By prioritizing financial health, organizations build trust, enable innovation, and continue to impact the communities they serve positively.