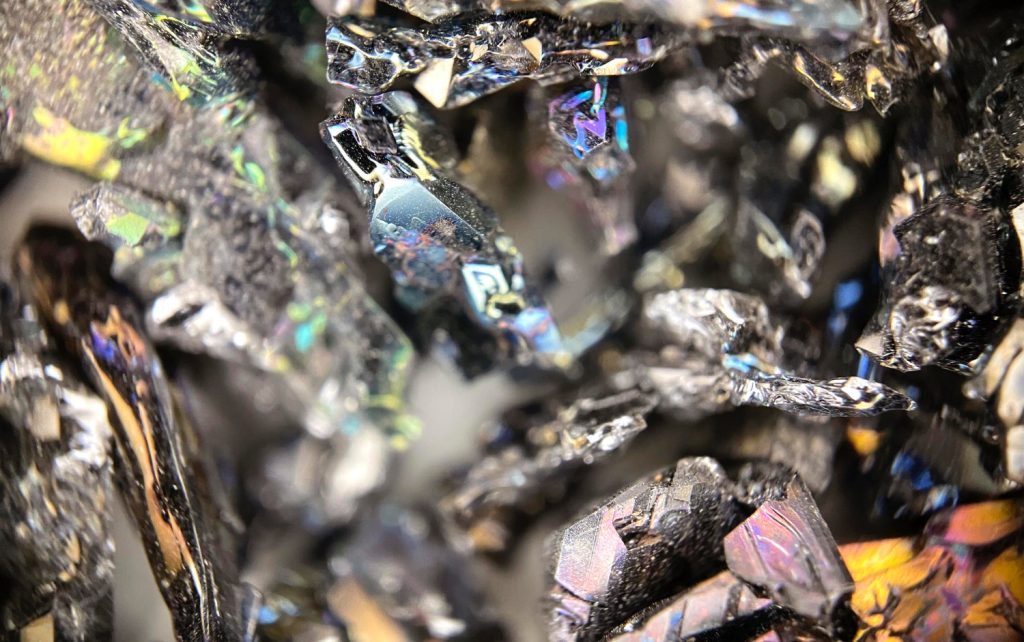

Gold and silver catch the eye, but their stories run deeper than shine. Precious metals sit at the intersection of geology and geopolitics, culture and chemistry. They secure vaults and anchor circuit boards, move wiht headlines and with factory schedules, signal status in one context and enable clean reactions in another. Between ring finger and refinery lies a complete economy. This article steps past the romance and the panic to consider precious metals on their own terms. We’ll look at what they are and why they matter: from gold’s monetary symbolism to silver’s conductivity, from platinum-group catalysts to the quiet work of palladium in emissions control. We’ll trace how ore becomes inventory, how prices respond to interest rates and industrial demand, how central bank purchases, recycling flows, and substitution shape supply.

We’ll weigh environmental and social costs alongside technological utility, and set common claims-safe haven, inflation hedge, store of value-against evidence rather than lore. The aim is not to praise nor to condemn, but to map the terrain. Beyond glitter lies a network of trade-offs: durability versus volatility, scarcity versus substitution, short-term profits versus long-term externalities. By approaching that network with clear questions and a level gaze, we can understand precious metals as they actually function-in jewelry boxes and balance sheets, in catalysts and policy debates-without losing sight of either their luster or their limits.

From Mine to Vault Responsible Sourcing, Storage and Cost Control

Ethical value begins long before a bar is stamped. Neutral assessment focuses on verifiable traceability, documented due diligence, and independent assurance across extraction, refining, and transport. Frameworks such as the OECD Guidance and LBMA Responsible Sourcing offer practical baselines, while on-the-ground realities-permit integrity, labor practices, and emissions-demand consistent evidence rather than glossy claims. The aim is simple: align physical metal with provable origin and clean title without romanticizing the supply chain.

- Origin Proof: Mine-of-origin declarations, export permits, chain-of-custody logs

- Refinery Standards: LBMA/ISO certifications, audit summaries, KYC/AML controls

- Environmental Data: Energy mix, water use, tailings handling, verified offsets

- Social Safeguards: Labor conditions, community consent, grievance mechanisms

- Transport Integrity: Sealed bag/bar numbers, tamper evidence, insurer records

Once metal is refined, total cost of ownership hinges on custody model, location, and financing. Storage fees, insurance, and bar-size premiums can outweigh spot price nuances if ignored. Allocating by serial number improves clarity but may reduce flexibility; pooled positions add agility but require counterparty comfort and solid reporting. Neutral cost control balances security with liquidity: optimize bar formats, negotiate tiered storage, and match duration with hedging or leasing only where it truly reduces net risk.

| Model | Ownership | Liquidity | Typical Fee | Note |

|---|---|---|---|---|

| Allocated | Specific Bars | Moderate | Higher | Clear Title; Serials Tracked |

| Segregated | Isolated Space | Moderate | Higher+ | Operationally Pristine |

| Unallocated | Claim on Pool | High | Lower | Counterparty Reliance |

| Bonded Vault | Duty Deferred | High (Cross-border) | Varies | Trade Facilitation |

- Cost Levers: Bar-size mix, consolidated shipping, location arbitrage, insurer deductibles

- Risk Levers: Multi-vault dispersion, dual-control access, daily reconciliation, audit cadence

Final Thoughts…

Step back from the display case and the trading screen, and precious metals become less of a spectacle and more of a study. They sit at the intersection of geology and policy, craft and circuitry, symbolism and supply chains-neither saviors nor culprits, but materials with histories, uses, and consequences. Looking beyond glitter means holding several truths at once: that scarcity can be economic as much as physical; that a coin can be both a story and a hedge; that a ring, a catalyst, and a circuit trace can share the same atomic number; that environmental and social costs coexist with durability and recyclability. It invites questions that outlast the market cycle: Where did it come from? What does it enable? Who bears the risk? What endures when the price chart is folded away? In that quieter light, metals become clearer. Not promises, not threats-just elements shaped by human choice. And the value we assign to them may say as much about us as it does about the metals themselves.